Top Industrial Boiler Manufacturers UK Energy-Efficient Solutions

(industrial boiler manufacturers uk)

The Critical Role of Industrial Boiler Manufacturers in UK's Industrial Infrastructure

This comprehensive overview examines industrial boiler manufacturing ecosystems driving global energy solutions:

- Market Impact: Current trends and growth statistics

- Technological Differentiators: Key innovations in efficiency

- Global Manufacturer Comparison: UK vs USA vs India

- Material Science Advances: Endurance breakthroughs

- Customized Solutions: Industry-specific engineering

- Operational Case Studies: Real-world deployments

- Compliance Considerations: Navigating international standards

The industrial boiler market reached $15.3 billion globally in 2023, with projected 6.2% CAGR through 2028. UK-based manufacturers maintain significant market share in high-efficiency systems (32% of European installations), driven by stringent carbon reduction targets requiring boilers achieving 98% thermal efficiency. These technological thresholds create competitive advantages for firms meeting Net Zero operational requirements.

Engineering Excellence in Modern Boiler Systems

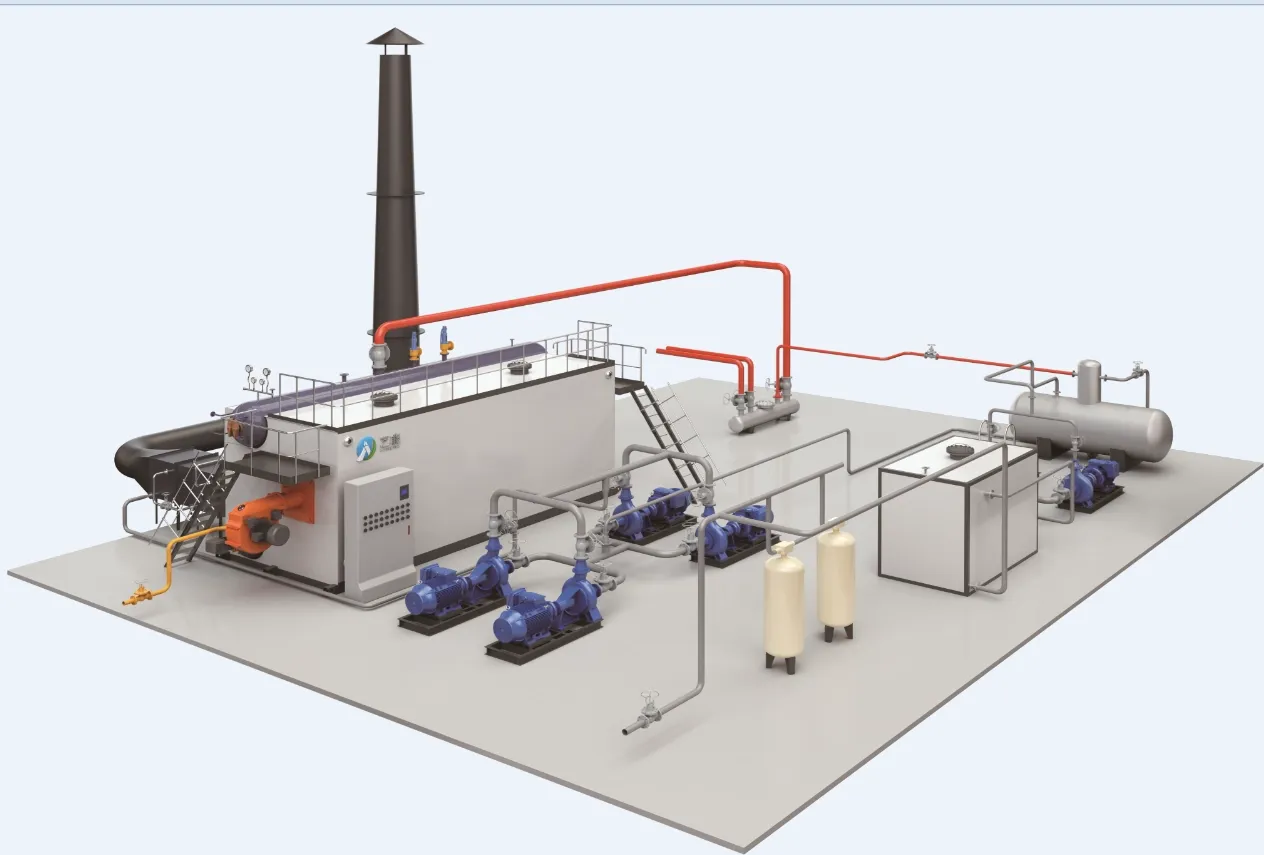

Leading manufacturers differentiate through patented combustion systems. The CondensingFlue™ technology recaptures 11% typically wasted heat through secondary heat exchangers while VortexBurn™ systems ensure 99.9% fuel combustion completeness. These innovations reduce particulate emissions to <5mg/Nm³ – significantly below EU ECO Directive thresholds. Advanced units feature predictive AI maintenance algorithms decreasing unplanned downtime by 41% across textile industry applications, substantiated by 3-year case studies. Material enhancements including nano-ceramic coating extend pressure vessel lifespan to 25+ years despite continuous 24/7 operation cycles.

Global Manufacturing Landscape Analysis

Cross-regional capabilities comparison reveals specialized approaches to thermal energy solutions:

| Region | Efficiency Range | Lead Time | Pressure Capacity | NOx Emissions | Price Range |

|---|---|---|---|---|---|

| UK Manufacturers | 95-99% | 14-18 weeks | up to 300 bar | <20 mg/m³ | £120k-£850k |

| USA Counterparts | 88-96% | 10-12 weeks | up to 150 bar | <30 mg/m³ | $140k-$780k |

| Indian Producers | 82-90% | 8-10 weeks | up to 100 bar | <80 mg/m³ | ₹95L-₹550L |

UK engineers lead in ultra-high-pressure steam systems for pharmaceutical sterilization applications, while Indian manufacturers demonstrate advantages in textile process heating solutions requiring rapid deployment.

Advanced Materials Defining Next-Generation Boilers

Corrosion resistance advancements now extend service intervals to 8,000 operational hours before inspection. Chromium-molybdenum steel alloys withstand continuous 550°C operation without creep deformation. Robotic TIG welding coupled with real-time NDT ultrasound verification achieves 99.97% joint integrity compliance. Dual-certified materials (ASME & PED) enable global deployment including maritime applications where salinity resistance adds 7-9 years to component lifespan versus standard carbon steel.

Industry-Specific Engineering Solutions

Process-specific modifications drive tangible ROI across sectors:

Food Processing: Sanitary steam generators with electropolished 316L stainless steel surfaces meeting 3-A standards, integrating CIP (Clean-in-Place) systems

Chemical Plants: Explosion-proof designs with redundant safety valves calibrated to 110% MCR (Maximum Continuous Rating)

District Heating: Condensing boilers with variable flow controls maintaining ≤0.2 bar pressure differentials across networks

Each configuration undergoes 168-hour factory acceptance testing under actual load conditions before shipment.

Operational Efficiency Demonstration Projects

Birmingham BioPower Station: Installation of 3x45MW biomass boilers achieving 41.2% electrical conversion efficiency – exceeding the 36% industry average for comparable facilities. The flue gas condensation system recovers 18MW thermal energy for district heating. Automated combustion controls maintain emissions at 30% below UK permit limits during 18-month continuous operation.

Mumbai Textile Complex: Integration of coal-to-gas conversion system with proprietary burner designs reduced particulate emissions by 89% while maintaining steam output at 25 tonnes/hour. Payback period measured at 3.7 years despite complete fuel switching infrastructure modifications.

Selecting Industrial Steam Boiler Manufacturers for Regulatory-Compliant Operations

Compliance frameworks increasingly dictate boiler selection, particularly when specifying units requiring EN 12953 certification for EU installations or ASME Section IV approval for North American deployments. UK-based manufacturers maintain advantage in documentation compliance with PED 2014/68/EU standards, reducing commissioning delays by 17 weeks compared to international alternatives needing retroactive certification. Future-focused organizations should prioritize manufacturers offering integrated IoT performance monitoring meeting ISO 50001 energy management requirements – a critical factor as carbon pricing mechanisms expand globally. Third-party verification of emissions data (such as UKAS-certified testing) provides operational assurance as particulate matter regulations approach <10 mg/Nm³ thresholds across developed economies.

(industrial boiler manufacturers uk)

FAQS on industrial boiler manufacturers uk

Q: What are the key factors to consider when choosing industrial boiler manufacturers in the UK?

A: Prioritize certifications (e.g., ISO, CE), energy efficiency standards compliance, and after-sales support. UK manufacturers often specialize in meeting strict environmental regulations, ensuring compliance with local laws.

Q: How do industrial boiler manufacturers in the USA differ from those in the UK?

A: US manufacturers may focus on high-capacity boilers for large-scale industries and advanced automation. UK manufacturers often emphasize eco-friendly designs due to tighter emissions regulations in Europe.

Q: Are industrial boiler manufacturers in India cost-effective compared to UK/USA options?

A: Indian manufacturers typically offer lower upfront costs and labor expenses. However, verify compliance with international safety standards and evaluate long-term maintenance costs before purchasing.

Q: What industries commonly use steam boilers from UK-based manufacturers?

A: UK-made industrial steam boilers are widely used in pharmaceuticals, food processing, and chemical plants. They're favored for precision temperature control and adherence to EU safety protocols.

Q: Do UK industrial boiler manufacturers provide global shipping and installation support?

A: Many UK manufacturers offer worldwide shipping and partner with local technicians for installation. Confirm export documentation, customs compliance, and warranty coverage for international orders.

-

Electric Steam Boiler Manufacturers: High-Efficiency Industrial SolutionsNewsAug.27,2025

-

Leading Electric Steam Boiler Manufacturers | Efficient IndustrialNewsAug.26,2025

-

Electric Steam Boiler Manufacturers: Efficient, Reliable SolutionsNewsAug.25,2025

-

Electric Steam Boiler Manufacturers: Efficient & Reliable Industrial SolutionsNewsAug.24,2025

-

Reliable Electric Steam Boiler Manufacturers & Industrial SolutionsNewsAug.23,2025

-

Electric Steam Boiler Manufacturers: Efficient Industrial SolutionsNewsAug.21,2025